Crypto Betting Sites Reviews 2025

Get latest sportsbooks, casinos, gambling and more reviews

-

XBet Review

Read XBet Review

-

1Win Review

Read 1Win Review

-

1xSlots Review

Read 1xSlots Review

-

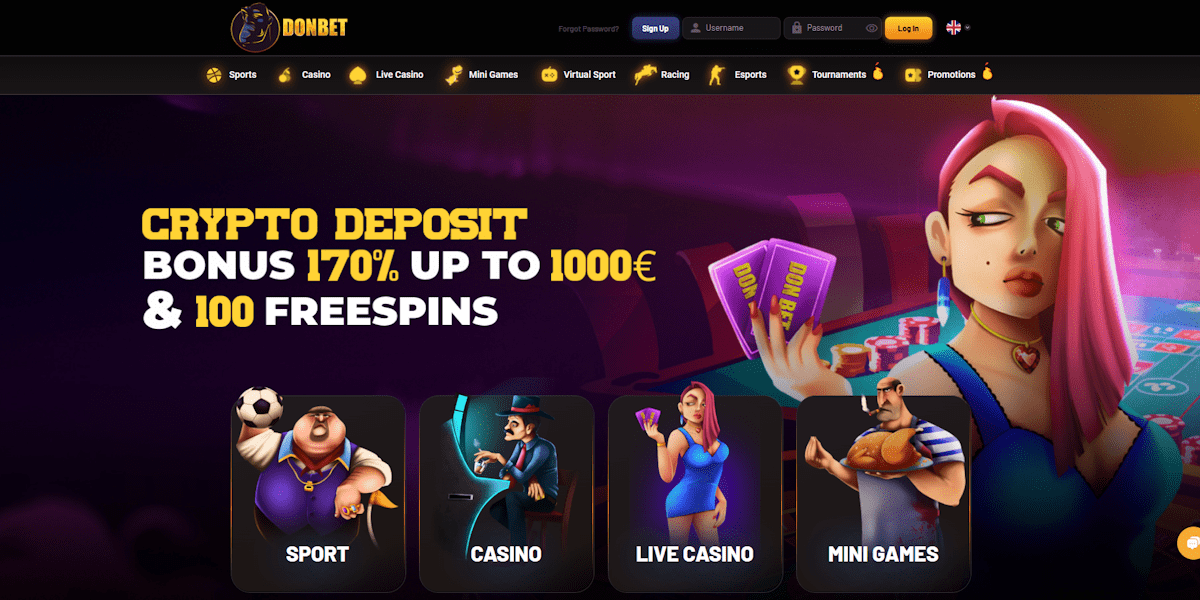

DonBet Review

Read DonBet Review

-

Bitcoin Games Review

Read Bitcoin Games Review

-

Thunderpick Review

Read Thunderpick Review

-

22Bet Review

Read 22Bet Review

-

Betplay Review

Read Betplay Review

-

El Royale Casino Review

Read El Royale Casino Review

-

SportsBetting Review

Read SportsBetting Review

-

PlayUSALotteries Review

Read PlayUSALotteries Review

-

1xBit Review

Read 1xBit Review

-

Betcoin Review

Read Betcoin Review

-

Coin Poker Review

Read Coin Poker Review

-

PlayHugeLottos Review

Read PlayHugeLottos Review

-

Bets.io Review

Read Bets.io Review

-

Bookmaker Review

Read Bookmaker Review

-

Ya Poker Review

Read Ya Poker Review

-

SwC Poker Review

Read SwC Poker Review

-

mBit Casino Review

Read mBit Casino Review

-

FairSpin Review

Read FairSpin Review

-

Red Dog Casino Review

Read Red Dog Casino Review

-

Rolletto Review

Read Rolletto Review

-

Wintomato Review

Read Wintomato Review

-

Lotto Agent Review

Read Lotto Agent Review

-

Aussie Play Review

Read Aussie Play Review

-

All British Casino Review

Read All British Casino Review

-

BitStarz Review

Read BitStarz Review

-

BC.Game Review

Read BC.Game Review

-

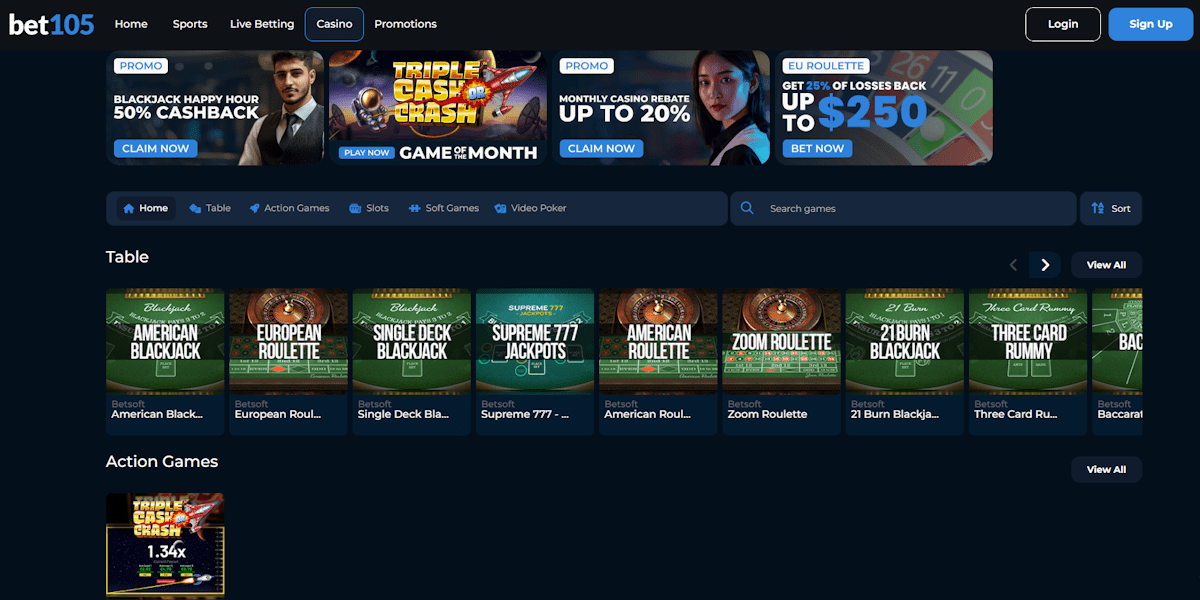

Bet105 Review

Read Bet105 Review

-

EveryGame Review

Read EveryGame Review

-

SportsBet.io Review

Read SportsBet.io Review

-

Tiger Gaming Review

Read Tiger Gaming Review

-

Bitcoin Casino Review

Read Bitcoin Casino Review

-

Sportbet one Review

Read Sportbet one Review

-

MyBookie Review

Read MyBookie Review

-

Las Atlantis Review

Read Las Atlantis Review

-

iWildCasino Review

Read iWildCasino Review

-

FortuneJack Review

Read FortuneJack Review

-

Juicy Stakes Review

Read Juicy Stakes Review

-

Slots Empire Review

Read Slots Empire Review

-

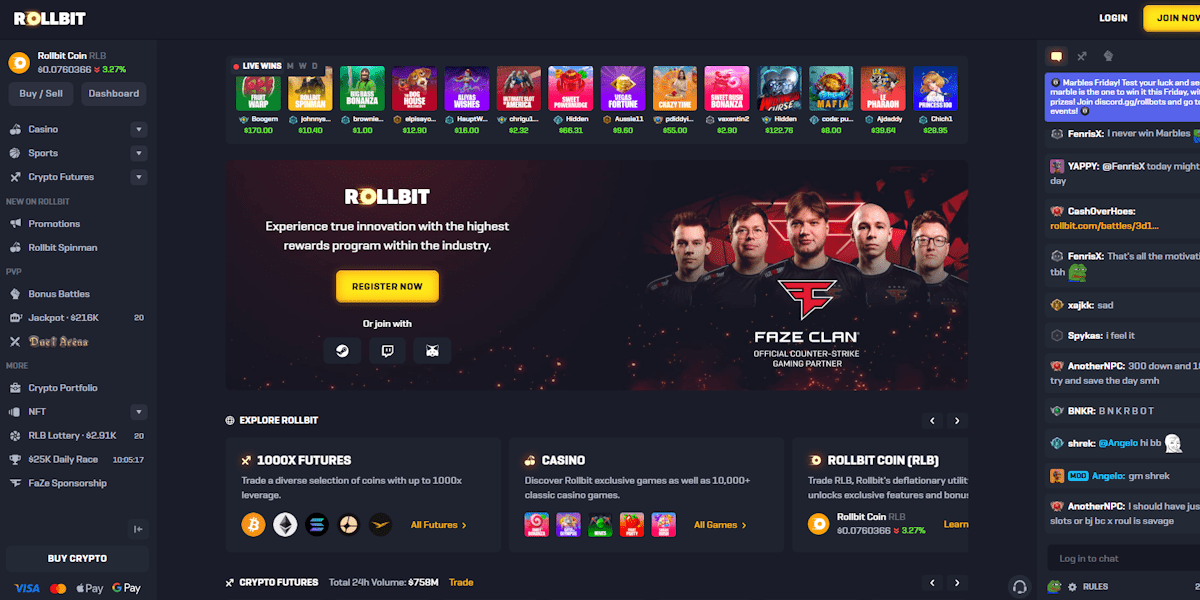

RollBit Review

Read RollBit Review

-

BetUSR Review

Read BetUSR Review

-

BetOnline Review

Read BetOnline Review

-

Lotto247 Review

Read Lotto247 Review

-

1xBet Review

Read 1xBet Review

-

Winz.io Review

Read Winz.io Review

-

Mystake Review

Read Mystake Review

-

Thelotter Review

Read Thelotter Review

-

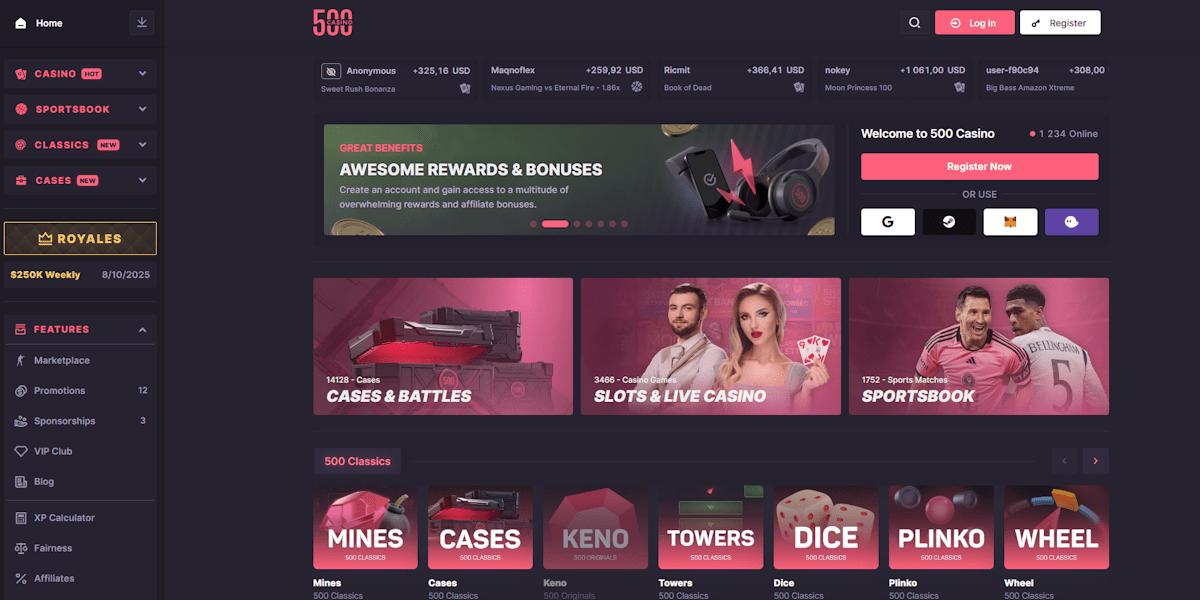

500 Casino Review

Read 500 Casino Review

-

LTC Casino Review

Read LTC Casino Review

-

Blockchain Poker Review

Read Blockchain Poker Review

-

Americas Cardroom Review

Read Americas Cardroom Review

-

Arcanebet Review

Read Arcanebet Review

-

BitSlot Review

Read BitSlot Review

-

Rocketpot Review

Read Rocketpot Review

-

Nanogames Review

Read Nanogames Review

Reviews explained

At bestcryptobetting.org you will find real bonus experiences from players for players! We use similar evaluation criteria as some of our competitors, but with us you benefit from a certain plus in authenticity and real initiative.

It is very important to not only focus on the bonus alone, but on the entire bookie. For example, a great percentage with a high bonus amount and very fair turnover conditions are of no use to you at all if the bookmaker offering the bonus is customer-unfriendly in other areas or acts as a dubious betting provider and thus a payout of winnings is generally questionable.

For example, we always contact the customer service and test their competence and friendliness. No detail, no matter how small, but perhaps very important, should remain hidden from you. So we mercilessly look into the seriousness, security, usability and other central aspects for an all-round relaxed betting experience.

Some other info sites can also come up with subjective experiences. - However, we approach the evaluation of bookmakers with a large team of real sports betting experts and are guaranteed to always try out all features thoroughly, which usually results in the most satisfied readers.

You can rely on us to provide you with highly detailed data and reliable reports based on it.

We don't just log on to the bookie and look at the payment methods that are basically available and how the transfer procedure works in theory. We try all this out in practice, activate the welcome bonus and bet with the bonus money as well as real money. This way you get information that none of our competitors can offer you!

After the analysis work, we have an overall rating for each bonus or provider. This in turn flows into our extensive database. A simple but highly informative points system is then used to draw up the final sports betting bonus comparison. Of course, you will always find the best bonuses and betting providers at the top of our ranking. Elementary facts about the respective deal are already provided in the overview, so that you can quickly decide whether an online betting bonus is at all suitable for you or not.

Now, it is of course the case that the different bonus offers can change from time to time. Therefore, we regularly check their validity at various levels. For you, we check whether the respective bonus is generally still available and go through the terms and conditions to see whether something has changed in the fine print.

In addition, our work brings us into contact with the bookies' customer services and decision-makers again and again. So it happens more often that we can get an exclusive betting provider bonus for you, which may offer better conditions than the standard deal.